Chris Skinner interview: the future of banking

During our USI Event last summer we (Stephen Perin & Sylvain Fagnent) had the chance to interveiw Chris Skinner on the future of banking. Chris also did a presentation at this event (The future of money trade and finance). This interview has been transcribed by Natalie Schmitz (Octo Technology).

S. Perin & S. Fagnent: Banks around the world. What is your perception of European banks and, for instance, digital banks? What do think about what Francisco Gonzalez, CEO of BBVA, said about “In 10 years, only 100 banks will have survived the digital wave.” And could you give us a small focus on the UK, even though your presentation already gave us some information.

C. Skinner: Sure. If you’re looking for innovation around the world the countries that tend to show it and demonstrate it the most are those that have the least legacy. China is doing amazing things with Tencent and Wechat, and Alibaba, and what we’re seeing now with MYbank (Alibaba) and Webank (Tencent). Africa, I mentioned, is doing amazing things with mobile and innovation around mobile financial inclusion using a completely different model that is nothing like the old banking system. And in Europe, the main innovation countries are Turkey and Poland – if you include Turkey in Europe – because most of their systems weren’t around in 1990, so they were implemented after the internet.

MYBank

MYBank

I was just in Istanbul and some Turkish banks were saying to me that they have a study tool of America. And in fact, very strange, the American banks are all talking about replacing core systems because their core systems are not new, you know. They’ve been refreshed but they weren’t meant to, you know, after the internet was developed. The problem for most banks – this is true in France, U.K., Germany, America – is that the systems were implemented before Mark Zuckerberg was born. Before the internet was envisaged, in some cases. I knew a bank in the day that was very pound of the fact that they were the first bank to digitize in their country. And they implemented an IBM mainframe in 1961. I did ask the question: Is it still running? It’s in a museum, thank goodness. But I think the system is still involved in a lot of… Um. A UK bank I know is still running a system that was pre-1971 because it’s in old shillings and pence which is pre- our currency as it is today.

In Europe it is mainly better, because when the Euro came in our older core systems were updated for transaction management in most European countries. Y2K did a refresher on old systems. But it’s quite clear here in France, for example, that BNP Paribas had to launch Hello Bank (I thought it was a separate bank) because they couldn’t develop a system that could be appropriate for the front end of a mobile bank, although I’ve learned since that it’s actually still used in quite a lot of their old core systems. [In the back, yeah.] In the back end.

C.Perin & S. Fagnent : As is Soon, too. Soon from AXA Banks. The core banking system is the same.

C. Skinner: The problem was demonstrated by Simple. When BBVA bought Simple, Simple was working fine. And yet suddenly it couldn’t do real-time updates, mainly because the banking systems aren’t fit for real time. And this is the core issue, which is that if you don’t have a real-time banking system you’re not fit for purpose. You know, if things are operating in batch they’re not fit for the 21st century, 24/7 mobile internet. And most banks are irritating me mainly because they believe by putting front-end systems in place they give a great user experience and that that’s all they need to do for a digital project, whereas actually that’s just lipstick on a pig cause that’s the front end. The back end is where the problem is. [Exactly.] You need a digital banking system.

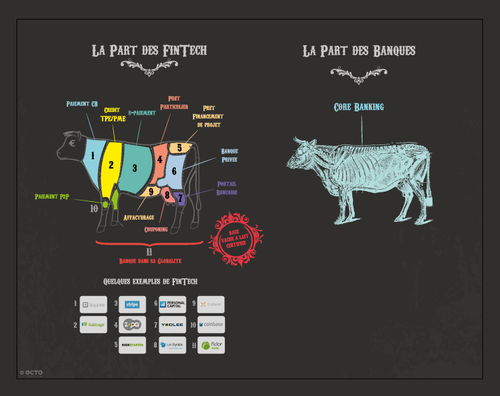

C. Perin & S. Fagnent : Last year with Stephen we started with Fintech cannibalizing banks. Our next step was to do an event where we changed perspectives and said: Now they have to collaborate. What is your point of view on cannibalization and collaboration between Fintech and the whole of banking?

C. Skinner: There’s a lot of discussion around “Fintech will eat the banks’ lunch” and “10 years from now banks won’t be around, and branch will disappear everything will be on a Fintech platform on a digital device.” I thoroughly disagree. Totally disagree. Banks are actively engaging with intercommunity and collaboration partnerships, nurturing innovation, investing in incubators… Really creating the next generation of financial system and making sure they own a good part of that system, rather than being eaten by it. If you add on to that that right now most Fintech operations, take the Prospers, Lending Clubs, Stripes of this world, aren’t really doing that much business compared to the global banking system in its entirety which is in trillions of dollars, not billions. Then you sort of say, well some of these things will become a threat to the core operations of banks but the question is did your bank do anything about it before it became a threat? And what I mean by that is that peer to peer lending will take a lot of business away from the credit operations of the traditional banks. If the traditional bank doesn’t wake up and do something about that, then obviously it isn’t going to be capable of surviving. So some banks will disappear.

Actually, going back to the comment from Francisco (Gonzalez) of BBVA about 100 banks being left in the world, I don’t agree with that either. And the reason I don’t agree with that is that it would be a system that’s definitely too big to fail. There’s over 200 countries; you can’t have 100 banks serving the whole planet, the systemic risk would be far too great. Now, you may have a 100 banks in every country, which actually might be more likely, with 3 or 4 big trusted brands that still retain their trust because they’ve evolved and invested, and made sure that they’re collaborating and partnering, and internalizing innovation. But, equally, there might be another 96 banks that serve boutique needs.

Francsico Gonzalez (BBVA)

Francsico Gonzalez (BBVA)

So if I want a purely digital bank on a mobile device that’s actually usable just by my shoes and watch, because it’s the Internet of Things, then maybe there’ll be a boutique bank that serves that specific need 10 years from now. So it’s really about large banks – as they are today – making sure they evolve, internalize, understand, and invest in building their futures. Which might actually mean having separate banks, boutique banks, of their own. Just to illustrate something in the final bit there, BNP Paribas for example with Hello might end up with 12 Hellos 10 years from now. 12 different banks all run by BNP Paribas, just serving different boutique specialist needs. And of those 12 they may actually have an ecosystem of partnership and incubation that’s part of those. So they may have built the back-end system themselves and offer the front-end system as their own interface to that service.

It’s really being far more adaptable, agile, and flexible than ever before and, in fact, that was the key thing I was saying in the presentation. In the old days when we controlled everything (the physical structure), we also controlled all of our developments internally which is why most banks made proud they have thousands of developers. When you have more developers than Microsoft has on Windows, that’s stupid. What banks need to do is just to say: We don’t need all this internalized stuff. Just go out and buy it. Partner with it, integrate it. Bring it in so that it’s the best experience for the customer and for the aim of the particular service the bank’s offering.

S. Perin & S. Fagnent: An option of Open Innovation, in a broad sense.

C. Skinner: Yes.

S. Perin & S. Fagnent: Do you think that Google, or similar, could be a bank some day?

C. Skinner: No.

S. Perin & S. Fagnent: No? Why not?

C. Skinner: To be honest, Google, Facebook, Amazon, Apple, if any of them try to get into core banking it would kill them because it’s just too riddled with regulation, compliance, and government control. The government control of the financial system is wrapped into the financial system incestuously. I mean, the government even had sister and brother government banks. The reason why Google, Apple, Amazon won’t get into it is that that’s not where the profit is. The profit is in the ancillary services that go around the financial system. Profit’s in credit, loans, mortgages, payment transactions. It’s not in deposit accounts. Apple Pay’s already taking a good squeeze of the action by forcing American banks to reduce their transaction charges to be in their wallet. That’s where they’re making the money. When you have a powerful, dominating brand you can have the banks subservient to you. And that’s exactly what Apple, Google, Amazon are doing. They’re saying: If you don’t fit in with what we want, then we’ll go to your competition.

S. Perin & S. Fagnent: Regarding regulation, the UK is set apart. But you said that, for instance, Google can’t be a bank because of regulation and so on. Would that still be true in the UK, which is move favorable to new entrants?

C. Skinner: Well, there’s quite a lot of spin around London in terms of what we’re doing with Fintech and regulation. I see numbers that say that we have more people involved in the London radius than in Silicon Valley and Wall Street put together. If you believe those numbers, good. That’s good for marketing, branding UK. But the real thing that’s happening in London which is unique, which I don’t see happening anywhere else which is why I’m excited because it’s where I live, is that you have the regulators, the technologists, the academics, the financial system all sitting side by side together and working together to understand this stuff and to innovate in a way which is acceptable and can be implemented for all. London wants to be in the center of that because, as a global financial center historically, how will you be one in the future – you’ll only be one if you’re leading Fintech because that’s the next generation from actual service, so if you’re not in that space you have a problem.

So when I see regulators saying they’re banning bitcoin cryptocurrencies, or when I hear say all the criminals are using bitcoin for payments, I don’t hear that when I talk to the regulators. What I hear is that there is some criminal activity around bitcoin cryptocurrencies but that it’s not massive yet, compared to the cash-based system of crime. They’re monitoring it very carefully and then working out how to institutionalize innovation in a way that regulators of the financial system can make operational. By way of example, I’m working with a shared ledger group which consists of UK Treasury, UK Bank of England, UK regulators, UK big banks, UK big corporations, consultants, academics, and people like me.

On the basis that we’re all trying see how to build a next generation system using shared ledgers rather than leaving out in the wild for the criminal fraternity and others to use it. I don’t see that everywhere else, I mean, I see it in America in that the White House has been actively engaging Fintech recently to do the same thing. To understand what this is all about. [France is at the beginning.] I recently went to Ukraine and Thailand and countries where, as soon as you say shared ledger and innovation and Fintech, they say “We have banned it. This is bad.” You can’t ban something because you think it’s bad, because it’s out there. And if you leave it unregulated, it becomes even more disturbing. It needs to be understood and incorporated. Going back to the original question, that’s why London is actually leading this. For Australia I mentioned CoinJar, which is a bitcoin wallet along with other currencies, and the Australian bank basically wouldn’t allow them any development capability or support so they came to London. Because that’s where they could get support. Not just support in terms of regulatory understanding but, equally, support that’s in the ecosystem of all the professions that need to be involved.

S. Perin & S. Fagnent: One key point about England is also the regulations for the consumer. They are facilitators, making it easier for consumers to move their banking data from bank to bank… And all these other regulations which are very unique in Europe, maybe even the world.

C. Skinner: That touches another point that I raised with the Fintech guys, which is that if you look at Michał Panowicz at mBank who is now to lead their digital projects, one of the things he keeps saying is that, at mBank, they have 4.3 million customers. Now, if you look at Moven, Simple, Fidor, they haven’t even really broken over a 100,000 customers yet. The only bank – new bank, neo-bank – that I see succeeding in growing a good portfolio is Chebanca in Italy which has gotten a good 500,000 customers in 7 years, but that’s actually a proper bank with branches. It’s not a digital-only bank. And one of the key things about Chebanca is, where they have a branch, they say they have two and a half times more assets deposited than where they don’t because customers trust the bank more when they see a physical representation of the bank.

CheBanca

CheBanca

And so, at mBank, they have converted about 3 million of their 4.3 million customers across to their new digital platform but a lot of that is supported with a physical branch operation representation.

Take Barclays, they’re converting a lot of customers across to digital platforms but they have Digital Eagles in their branches who train customers about how to use this stuff. And any people who don’t want to be trained to use it are people around the age of 30, male, arrogant, and they just don’t want to be shown how to use this stuff. Often people say “Oh, old people don’t use iPads.” Well of course they use iPads. But they might not use it for banking because they don’t trust it until someone explains that this is just the same as when you go on the internet. It’s exactly the same! The only difference is you’re accessing from somewhere that’s far more convenient.

S. Perin & S. Fagnent: How do you improve current banks? Where to start? Traditional banks, like BNPP and so on, want to be digital so where to start? Their legacy? Build another bank with a new CBS (Core Banking System)?

C. Skinner: I’ve written a couple of posts around where banks should start and I think the first thing is: Do you really buy into the change program that you think the bank has to take? And what I mean by that is … There’s an old joke that goes: At breakfast, the chicken is participating but the pig is committed. This is where you have to start. Are you just participating? Most banks I encounter are doing digital projects and they’ve got a head of digital. They’ve given that person a budget and a staffed team, and that’s completely wrong because that’s delegating the change and basically saying “I’m going to give this to someone else to create the bank of the future.” So the question then is, well… If you have a head of digital and a budget and a project, that’s participating. That’s the chicken approach.

If you want to be committed, the pig approach is to say that actually all of the effective team have to buy into this and do it together. Every C-level person in the institution has to be part of a digital agenda of change and then that has to start with asking how we replace our physical assets and structures with digital assets and structures. As I said in the presentation, and as I keep saying all the time, is that you have to turn the model of the bank upside down so instead of delegating digital and keeping physical, you actually become digital and get rid of physical except where it’s needed on top of the digital platforms. And that’s an internalization thing that the executive team have to bite into. For example, you have to get rid of the product as part of a digital structure. You need customer structures, not product structures. Quite clearly that’s a massive change because you’re taking a lot of empires away from people currently at C-level in the institution. The CEO often doesn’t understand what digital really means to a bank, he just knows it has to be done. Which is why they bring in a head of digital – then the head of digital gets frustrated because none of the executive team is supporting their digital projects.

The CEO has to be the digital leader, not the person who’s head of digital. Once you’ve gotten over that hurdle, then you can start implementation because implementation begins with core systems, core structures, and core processes being completely ripped apart into a digital form. You can’t rip those apart into digital form until you’ve gotten over the first hurdle which is the executive team buying into it lock, stock, and barrel.

S. Perin & S. Fagnent: What about the social impact of digitization on banks and the financial industry’s business?

C. Skinner: Well, there’s obviously a social impact as we go into a new generation of finance based on technology and the social impact is … maybe three-fold. The first is that traditional banking will start to become unprofitable in the physical form. So those people who want branches and want to use paper will be excluded from the new banking system, because it’s digital. And, simply, the people who want to use branches and paper are those who are less sophisticated. So what it actually means is that the less financially competent – the less financially well-off – will probably be the ones who’ll suffer in the digital divide, just because the people who are competent and capable tend to be higher-income, higher-earners and are happy to serve themselves. If the digital user customer is the competent, capable customer how do you serve those who are incompetent and incapable in a digital world? And actually there is a way, but the question is how do you get this part of society to move in this direction which is mobile financial inclusion where the under-banks, the un-banks, the less competent, can get very simple services through apps on devices and very soon through wearables with the Internet of Things.

The only reason we have the physical structure there is because that’s what we have as a legacy of the last century. When it doesn’t make sense and we start getting rid of it all, you can’t have this outcry of “Oh! You’ve gotten rid of our branch!” when you don’t need a branch. Maybe what you have for those who are less capable and less competent is someone who comes and visits them and shows them how to use their mobile services; and then they have to use the mobile service from then-on or they have to visit the über-branch, which is not the taxi branch but the big branch out in the center of La Défense, or somewhere. The showcase branch. Think of it as our Genius Bar. If you have problems using our services, the Genius Bars are 20 across Paris instead of 20,000.

S. Perin & S. Fagnent: Any profound thoughts about banking to share with us?

C. Skinner: Well the only bit we missed, part of the social piece, is that traditionally banks have only focused on trade, commerce, profit, and money. What I keep saying in the value where dialogue, what we’re moving into, is that they need to be a part of understanding life, relationships, and the things we value. And our memories, for example. I don’t see many banks doing this, in fact the only one I regularly talk about is Fidor Bank, in Germany, and the reason I talk about them is that their spend on onboarding a customer is about 17€ total, including KYC, compared to 1500€ for an average, traditional bank. That’s because traditional banks push products through channels using traditional media whereas Fidor Bank developed conversations through social communities online, where they have become relevant in the conversation. Banks need to start to move into being far more engaged where the customer has relationships, which is on social networks not on traditional media. Then I think they’ll find they’ll succeed far faster in this new world than those that don’t.

A great example from ICICI Bank (and I must get this updated): when I saw them present a couple of years ago they moved all their branch people into being social media customer service representatives. They dedicated the whole bank into Facebook; they launched full-Facebook banking, full-service social banking not just conversations. They conversed 24/7 through their Facebook bank services with their customers and within 15 months they had moved from a negative score, in terms of net promoter score speak, of about -47% to +63% because they were engaging where the customers want to engage, which is in the network not in the branch.

S. Perin & S. Fagnent: About what you said this morning during the presentation that everybody’s connected (since everyone on Earth has a mobile) so there is a new way of banking through mobile. Will these countries show the “old” countries (Europe, the US) a new way of banking?

C. Skinner: I can’t say that I’ve seen much around mainstream Europe – going back to the first question around where innovation is coming in. I haven’t seen much about a new bank of the future coming from France or Germany, or Brittan. I’ve seen it more from Turkey… Spain actually is interesting because they’ve had quite a lot of activity. Santander, BBVA are all doing as far as … But also Banco Sabadell, Caja Navarra, La Caixa. If you look at Spain then probably more of the new things are coming from there, about where you see the next generation of European bank. Again, one of the things I did say this morning was that 7 billion people will now be included in finance in some form through the network and the question is what sort of bank form do you want to be in the future.