FinTech what are the next steps

Introduction

In 2014, my colleague Stephen Perin and I wrote “FinTech Is Cannibalizing Banks!” a White Paper that had a certain impact in France and even in Canada. We have been following the innovation in retail banking since 2010, and this WP was meant to create a sense of urgency.

In March, 2015, we organized a small Finovate in Paris (FinTech Day) where 20 French FinTech came to demonstrate their solutions. It was the first event of its kind in France. Sure, we are running behind when compared to London but now the French FinTech ecosystem is really expanding fast, is self organizing (Association Finance Participative). The funds raised, the acquisition, and the scaling of some actors is now underway.

Worldwide global Fintech investment jumped 201% between 2013 and 2014, breaking the $12B mark with more than 730 deals.

Investment in FinTech, Jan 2010 - June 2015, in USD (src: IC Dowson and William Garrity associates Ltd)

Investment in FinTech, Jan 2010 - June 2015, in USD (src: IC Dowson and William Garrity associates Ltd)

Insofar as FinTech domains expand faster and faster, many questions remain regarding this new eco system. Before the Fintech Montreal Event to which I was invited to participate, some of these remaining questions were sent to me. Here are the answers I gave.

The questions of 2015

Is the opportunity real or are we looking at another technology bubble like 2001?

Unlike what happened in 2001, the FinTech business model relies on the fact that FinTechs have identified customers’ pain points and, in response, provide them with outstanding user experience (customer centricity). Their transparent (no hidden fees) business models rely on data they analyze and collect. Data is definitely their new black gold. Their business models do not rely on clicks or page views. Besides, the technologies they use are rich and mature (mobile, cloud computing, Big Data, API, etc.). That was not the case back in 2001. Promises that were made in 2001 can be kept this time!

Nonetheless, we think that at some point there will be a phase of consolidation: mergers and acquisitions. It has already started in 2014 & 2015 and it will accelerate.

Significant and recent examples:

- LearnVest (PFM-like, that helps people reach financial security and save for their most important goals) was acquired by NorthWestern Mutual for $250million (March, 2015).

- Yodlee (PFM, financial data aggregator) was purchased by Envestnet for $600million. “Envestnet buys Yodlee and its treasure trove of 'permissioned' data by selling its vision of the future of financial advice” (August, 2015).

- PayPal bought several FinTechs in the online payment and mPayment sectors – Braintree (2013), Venmo (2013) and recently in the remittance sector: XOOM (July, 2015)

- BlacRock bought the robo advisor FutureAdvisor (July, 2015)

- BBVA (Spanish bank) bought Simple last year (2014) as well as several FinTechs like Madiva (Big Data company).

- At last, peer-to-peer small business lending platform Funding Circle which acquired Germany's Zencap (footprint in Germany, Spain, and the Netherlands) (October, 2015).

BlackRock acquired FutureAdvisor (Robo Advisor)

BlackRock acquired FutureAdvisor (Robo Advisor)

What have been the conditions for their success? Is it just technology or are there other forces at play?

FinTechs address a customer pain point in a specific business line for a specific client group; they are specialists. They focus on a single problematic. FinTechs are customer centric not product centric. They do reinvent (re-design I should say) the way we do banking, with or without banks. People understand this new approach because FinTechs care about their life goals and their everyday problems. They are design-driven companies.

Lige goals (Src: www.laserspinewellness.com)

Lige goals (Src: www.laserspinewellness.com)

As a response to this pain point, FinTechs provide outstanding user experience in a digital world. They are pure digital actors.

After the 2008 crisis a society trend emerges and banks are rejected: we need banking not banks. Besides, the government pampered new entrants (France, UK). In October, 2014, France established the first legal framework for crowdfunding, allowing the new entrants to do business legally.

Basically, the first wave of innovation came at the end of the 20th century with Internet. At that time, Internet was just used as an extension of previous business models. Roughly speaking, we were doing the same business through Internet. The 2nd wave is now. New business models are emerging, like the sharing economy, and tomorrow it will be the blockchain that will provide decentralized, smart systems/applications.  Digital Wave (src: images.forwallpaper)

Digital Wave (src: images.forwallpaper)

Despite their phenomenal user growth and ubiquity in everyday life, many small tech companies are struggling to make money. Can this trend be reversed? Can the smaller players be successful?

Success goes through ‘scaling’ and FinTech have many options to scale. We are only at the beginning. Here are the weak signals and illustrations of this trend.

Scaling by international expansion

In France PretD’union (P2P lending) will attack the Italian and Spanish markets which are more lucrative than the French (they raised €34 million to do that). Stripe has had a strong international expansion (21 countries so far). With Coinbase (bitcoin wallet) one can buy or sell bitcoin in 25 countries while their wallet is available in 190 countries. Fidor bank is opening in the UK (September, 2015). Kabbage started in the US and last year went across the Atlantic and settled in the UK. Recently, they also started a partnership through a pilot launched with ING in Spain. Moven rounded up $12 million in funding for international expansion (October, 2015). Peer-to-peer small business lending platform Funding Circle acquired Germany's Zencap, giving it an immediate footprint in Germany, Spain, and the Netherlands (October, 2015).

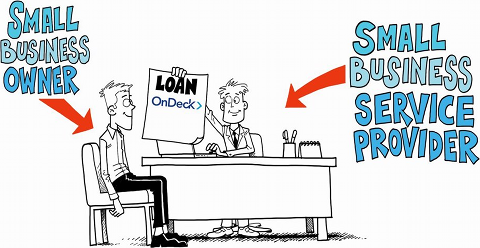

Scaling for FinTech can rely on other FinTech customer base or even bank customer base if both of them succeed in establishing partnerships

A very good example is BBVA Compass which teams with OnDeck to bolster banks small business offerings (May, 2014). OnDeck also teams with other partners like Intuit (September, 2015). Another good illustration is LendingClub (since September, 2014) that allows Union Bank to sell loans through its platform. The two organizations will also work together to develop new credit products and services to be made available to customers of both companies.

Ripple (private bitcoin platform) established several partnerships with Fidor, CBA (Common wealth Bank of Australia), and recently (October, 2015) with Santander that invested (through its venture subsidiary) $4 million in their solution.

Fidelity uses Betterment (Robo Advisor) in a white label partnership for its own clients (October, 2014). Kabbage is also licensing its platform to third parties. Recently (October, 2015), ING has signed a partnership with Kabbage. Besides, Kabbage uses data from a multitude of sources that small businesses use each day as a way to qualify borrowers. Kabbage understands a small business’ performance based upon data sources, which also include Intuit QuickBooks, eBay, PayPal, Amazon, Authorize.net, relevant shipping data, and more. Kabbage partnered with Sage, Etsy, Xero, and Intuit (among others) to access data, do better scoring, and build an eco-system around SME businesses and hence increased the rate of its solution adoption.

Scaling by Open Innovation and Open API (Application Programming Interface)

APIs are a way for different IT systems to transact with each other. Through partnerships, in-house development teams can integrate the functionality of another offering as part of their own.

FinTech CurrencyCloud (automated multi-currency international payment) had multiple partnerships with Fidor bank, MangoPay, Kantox, and TransferWise for international, multi-currency payments (B2B) – processing $10B in payments every year, across more than 40 currencies in 212 countries – before they offered an Open API on the internet that increased the use and adoption of their solution. Thanks to their Open API, other companies are able to develop new applications that need currency transfers (src. Currency Cloud).

CurrencyCloud API

CurrencyCloud API

“Xignite, the leading provider of market data cloud APIs (application programming interface), launched the#FintechRevolution API Ecosystem, an industry-wide initiative that connects FinTech developers with financial APIs. The goal of the initiative is to inspire a new generation of financial applications by assembling the best APIs in each market category. The #FintechRevolution API Ecosystem is open to financial technology vendors, data providers, service providers and accelerators. Founding members are 21 leading vendors that provide workflow, analytics and data APIs, including Yodlee, Stocktwits, Tradier and NASDAQ and FinTech accelerators including Level39 and ValueStream” (September, 2015, src. Xignite). By the way xignite surpasses 50-billion API calls in a single month.

The #FintechRevolution API Ecosystem

The #FintechRevolution API Ecosystem

Scaling for FinTech can go through banks that can massively adopt their platforms

In P2P lending, there is a very recent trend, perhaps because the sector has gained respectability: Scaling for FinTech can go through banks that can massively adopt their platform like Lending Club for instance. Bank and financial institutions took a major investment in Lending Club by funding their loans. In 2014, Lending Club moved from 80% of funding by individuals to 80% by financial institutions.

Lending Club - Bank Partnerships: Leveraging Each Other's Strengths: “Lending Club offers strategic partnerships to banks in order to bring affordable loans to consumers and small business bank customers. Through a partnership with us you can buy whole loans that fit your own credit policy and risk guidelines; and offer personal and business loans to your customers, benefiting from Lending Club's low cost of operations and national scale. A partnership creates value by combining the complementary strengths of Lending Club and your bank.”

Lending Club and Prosper loans by type (src: Quartz | qz.com; data: Orchard)

Lending Club and Prosper loans by type (src: Quartz | qz.com; data: Orchard)

Banks have large scale integrated distribution offering physical and digital channels. Will clients ever go digital only or is Multichannel required?

Branches must be reinvented, not stay like they are today that’s for sure (in France). They should transform: not to generalize, but more to become something specialized where the banking activity is only an element in the value chain. Branches should focus on customer’s problems and on their life goals: buying or renting a house, buying or renting a car… From there, they can focus on the customer’s life goal and approach the problem globally not merely financially. Branches should have skilled human advisors! Advisors should be more like life coaches => new skills, larger vision of running the business.

“Branches are not somewhere you go but something you do” (Brett King). Digital should be present as a link between the pure online interactions and the physical ones. Digital is something that lets you do anything (not only banking) by being connected anytime, anywhere. What we call “Digital” has a huge impact on society and on companies. But all channels must interact together – an omni-channel approach.

Digital natives might act differently and adopt full online interactions, maybe using skype or video chat, because they are already used to it. It’s natural for them.

You may dedicate (specialize) your channel to certain types of clients and adapt them to their habits/behaviors: digital natives, wealthy people under 45 use mobile while those over 50 use branches this is not universal for all channels. You might use a branch for your first interaction and for KYC but as soon as you can switch to a digital channel, you do it.

Digital Impact (src www.brookes.ac.uk).

Digital Impact (src www.brookes.ac.uk).

How traditional players like banks / insurers and wealth firms will react to this disintermediation? Can they move fast enough?

Banks still have a large customer base, money, and knowledge of regulation. On the other hand, FinTechs' DNA is made of inspiration focusing on specific client pain points (they are specialists), agility to innovate fast, and having employees with strong digital culture. The question is to know how banks will integrate these new innovations. Partnerships, investments, integration into subsidiaries, or buy-outs. They will probably end up doing all of these things and the early adopters, like BBVA, have already started. BBVA is adopting the disruptions – not fighting them – they are building and sharing a vision : what will your business be in 10 years.

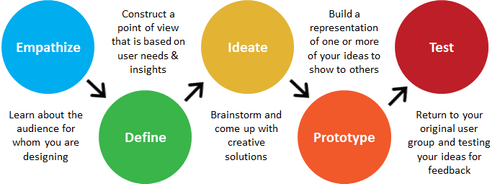

Re-invent your business through design thinking (design-driven approach)

Reinvent the business and the way customers should interact with the bank by reinventing the customer journey. To boost this strategy BBVA and Capital One acquired Spring Studio (April, 2015) and Adaptive Path (October, 2014), respectively. Both are design companies whose purpose is to reinvent the way of doing banking.

Define a mission, build a vision and share it with the employees

Defining a mission and a vision: bank's top management should ask themself what kind of bank they want to be in 10 years or less. Concentrate on functionalities, those they wish to put forward, and prioritize them. This allows to define what initial actions should be and which clients they should target first. Innovate with small steps, with small autonomous team, take affordable risks, measure the success or the failure, and adapt the next step of innovations (the lean start-up approach). This will provide the bank with MVP (Minimum Viable Product), which they can then rapidly deploy on the ground in order to make any necessary adjustments to the implementation before enriching it. Move from a delivery culture to a learning culture. Fore sure, big rationalization projects won’t help banks in reducing the progression of disintermediation.

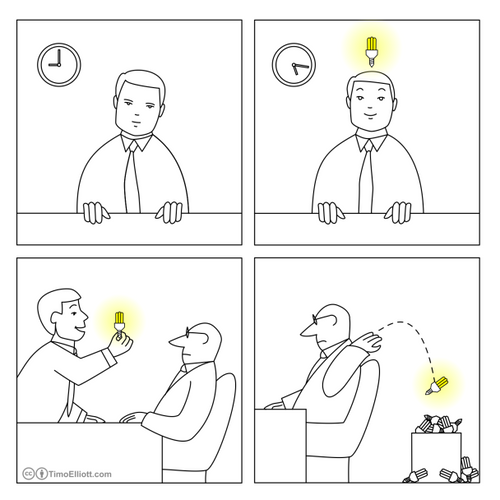

With their business model, Fintechs offer some kind of cannibalization of the old banking business models. Inside the banks the issue is that there will be very strong resistances that will slow or even stop the transformation or in other words the "immune system of the banks will start to kill the innovation from the inside". To succeed, it would be better to either create a new structure outside of the existing one or from the inside, like BBVA, you might have to change your structure to accelerate transformation and boost results

Legacy IT infrastructure that comes from the 70s and the 80s is a pain for banks

Legacy IT infrastructure will definitely slow them in their transformation. Massive investment should be done to have real-time banking infrastructure. Banks still have time and money, but they should start investing in their IT renovation because it can take upwards of 10 years to modernize or replace the old core banking system.

Capital One – one of the most innovative banks is undergoing digital transformation through infrastructure investment (amongst others). CapOne CEO: “Digital Is the Centerpiece of Our Agenda”: “We are not primarily motivated by cost saving with digital because I think that’s about fourth on the list of things that the power that digital provides. Right now, it is still a net negative and probably for an extended period of time measured purely by cost, digital will probably be a net negative.…Most of the leverage is really in infrastructure in terms of things like rationalized and simplified core infrastructure, increasingly we’re focusing on cloud computing and building the underlying capabilities such that product development will be faster and faster and more effective over time. In the end, he said, Capital One doesn’t do digital because it’s cool or to save money. It’s just that it’s the future, and Capital One wants to get there first.”

There are a significant number of Robo-advisors and wealth management sites hitting the market. Will they replace professional advisors or complement their practice?

Soon, just having the best human advisor will not be a sustainable competitive advantage in the wealth management business.

Src: Wallstreetdaily

Src: Wallstreetdaily

With no human advisors, be data-driven & automatically build yourself a 360° overview of your customer: by analyzing customer needs (capturing their life goals, risk aversions) and preferences through segmentation. To improve customer segmentation capabilities, you should aggregate external sources of data and create 360° customer models. Offer PFMs tools (Personal Finance Management) to aggregate account data transactions from several accounts and offer a consolidated vision of the customer’s financial situation. Use this aggregation to improve your customer segmentation.

Automated software (robo advisor) are used for:- Asset allocation and portfolio rebalancing with visualization

- Tax-loss harvesting algorithms

- Advanced visualization to enable aggregation and goal based reporting. Additionally, use machine-learning algorithms from your existing historical data of customer profiles, investment preferences, declared goals and asset allocation and improve your automated decision

Robo-Advisor should work in tandem with human advisors: human advisors will manage tax systems and legal aspects which are quite complex and region/country dependent. Human advisors might also be able to explain the robo’s choices to their customers.

Regulation & compliance: how is the regulatory regime being applied to new entrant? Is regulation a barrier to entry that will protect traditional lenders and managers’ market share?

It’s a threat in the short and mid-term. FinTechs should not ignore regulation and compliance.

Ripple & regulation: U.S. Treasury slaps virtual currency start-up Ripple with $700K fine: “Virtual currency exchangers must bring products to market that comply with our anti-money laundering laws” said FinCEN Director JC Shasky Calvery.

The CBS (Core Banking System) infrastructure is a barrier for new entrants. “For GAFA, if any of them try to get into core banking (which is licensed) it would kill them because it’s too riddled with regulation compliance and government control. This part is not a very profitable part” Chris Skinner told us during our July interview at our USI event. And he added: “In the UK, regulators, technologists, academics, and financial institutions all sit alongside one another and work together to understand what’s happening and how to innovate in a way which is acceptable and can be implemented for all”. Besides, as global tendency, regulation might come to protect the customers and not the bank (in Europe).

What is the next big thing that will be a disrupter or a disintermediator to the old banking system ?

All actors that will provide new services relying on the blockchain

Blockchain by nature and by essence disintermediates any system that hitherto was based on a trusted third party, such as banks or Swift for instance.

One of the first examples of blockchain use is in cryptocurrencies like Bitcoin. The distributed ledger records all Bitcoin transactions, shared by all participants, to the BitCoin blockchain which is accessible by anybody (public) and validated by complex and secured distributed processes which do not require a trusted (central) third party. Bitcoin allows remittance around the world at low cost (sometimes volatility problem is mitigated by the platform by offering a guaranteed rate and by using Bitcoins only for technical transfer). Platforms like Coinbase, Rebit (Philippines), ArtaBit (Indonesia) or BitPesa (Africa) provide or will soon provide services around remittance through Bitcoin.

The next steps could be services like Chain which for instance teams up with Nasdaq to develop on the blockchain protocol. Chain provides software allowing Nasdaq to privately clear trades in real-time. Chain focuses on private blockchain software developments.

The Chinese competitors

In a recent post Chris Skinner exposed his vision “I recently found some exceptional insights into how China is leading the world of banking, as we saw the opening of digital banks WeBank and MYBank. … – Alibaba and Tencent – are setting the benchmark for innovation in China and, from a financial markets viewpoint, the world … ”

They are definitely mature to operate in Europe or anywhere else and the range of financial services offered is large. They moved massively and fast. Now we know that Alibaba is about to investigate the cloud infrastructure market in Europe, with a next step that could be financial services(Alibaba future of banking ?).

But how long will it takes to see Alibaba offering its first financial services in Europe. My opinion is: not so long !

Conclusion

It's hard to conclude because we are facing a world of innovation that accelerates and never stops. Digital is reinventing the world and as Marc Andreessen said "software is eating the word". We are facing exponantial organization (see Salim Ismael presentation @Usi) which are extremely difficult to understand.

The only thing we know is this: in two years the banking environment will be quite different because of the digital transformation that will occur from inside the bank or from outside – it will happen, with or without them. Software will have an even bigger impact on society and banking. There Will Be No Exception.